Current Ratio Less Than 1

That being said how good a current ratio is depends on the type of company youre talking about. A current ratio less than 1 can tell us that the company O A.

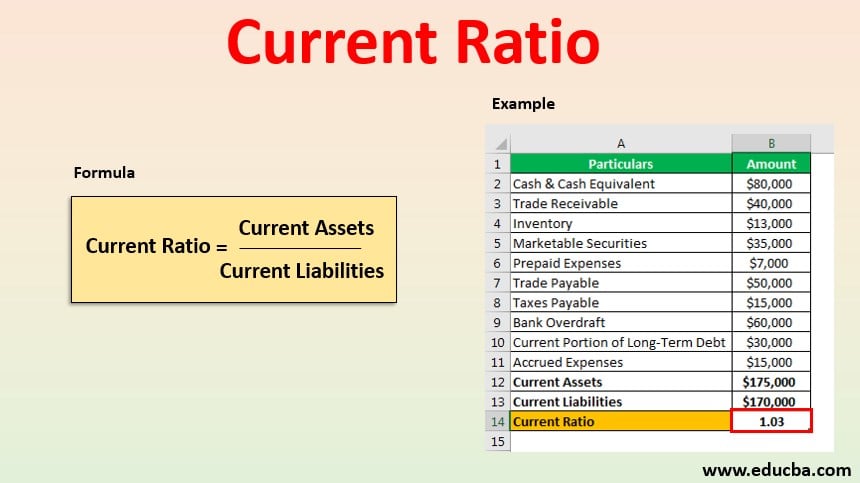

Current Ratio Examples Of Current Ratio With Excel Template

In airline business equity to assets ratio is also very low as airlines leverage.

/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

. A ratio of 1 means that a company can exactly pay off all its. Should be able to cover the current liabilities O C. Correct option is C Current ratio is the measure of liquidity of a company at the certain date.

A high current ratio can be signs of problems in managing working capital. The current ratio of less than 1 indicates that the business organization may not be able to pay the short-term obligations on the due dates. The current ratio therefore is called current because in contrast to other.

Acceptable current ratios vary from industry to industry. However you should remember that a higher current ratio. Given the structure of the ratio with assets on top and liabilities on the bottom ratios above 10 are sought after.

Hence with low current assets and higher current liabilities. If current liabilities exceed current assets the current ratio will be less than 1. By contrast a current ratio of less than 1 may indicate that your business has liquidity problems and may not be financially stable.

Therefore if the current ratio shows more than 1 then it can be considered more desirable. Some types of businesses can operate with a current ratio of less than one. When current ratio is.

A current ratio of less than 1 indicates that the company may have problems meeting its short-term obligations. For instance if the current ratio is less than 1 this means that the companys outstanding debts owed within a year are higher than the current assets the company holds. A liquidity ratio that measures a companys ability to pay short-term obligationsThe Current Ratio formula is.

It might be very common in certain. Should be able to keep. Current ratio ought to be less than 1.

The current ones mean they can become cash or be paid in less than a year respectively. A firm having a current ratio less than 10 has. More debts due within the next year than assets that should convert ta cash within that same time period.

Low values for the current ratio values less than 1 indicate. May have too much capital tied up in current assets OB. A current ratio less than 10 means that current liabilities exceed current assets.

If this is the case the company has more than enough cash to meet its liabilities while using its capital effectively. So in case of retail business there are some. The ideal ratio is 21.

Enough assets that will convert to cash in time to pay all of the debts payable within the next twelve months. In general a good current ratio is anything over 1 with 15 to 2 being the ideal. For most industrial companies 15 may be an acceptable current ratio.

A current ratio of less than 1 indicates that the company may have problems meeting its short-term obligations.

/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

Current Ratio Explained With Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

Current Ratio Explained With Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

Current Ratio Explained With Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)

Current Ratio Explained With Formula And Examples

0 Response to "Current Ratio Less Than 1"

Post a Comment